Abdullah Bozkurt/Stockholm

A front company affiliated with Hamas in Turkey is poised to launch a multi-million Turkish lira property development project in Istanbul, despite being subjected to sanctions by the United States, a NATO ally of Turkey.

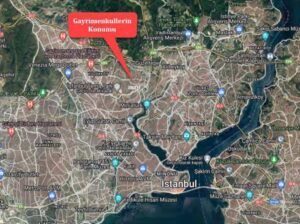

On November 11 Trend Gayrimenkul Yatırım Ortaklığı A.Ş. (Trend) announced the execution of an agreement with a Turkish contractor for the development of a prime property in Istanbul owned by Trend. The selected contractor, Araz Aviation, Petrochemical, Iron and Steel Trade Ltd (Araz Havacılık Petrokimya ve Demir Çelik Ticaret Limited Şirketi in Turkish), is set to construct 34 luxury apartments on a plot located in the Alibeyköy neighborhood of Istanbul.

Araz is a relatively obscure company established on March 24, 2021, with its sole proprietor listed as Sinan Karaduman. There is currently no available information indicating its prior involvement in property development.

The contract’s value remains undisclosed, but as of December 2022 the property, assessed by real estate appraisal and advisory service Yetkin Gayrimenkul Değerleme ve Danışmanlık A.Ş., was valued at 14.9 million Turkish lira for the land, excluding the existing buildings. It is important to note that Turkey experienced an official annual inflation rate of approximately 60 percent in 2023. Consequently, the property’s value is likely to have increased since Yetkin conducted the assessment on December 30, 2022.

The property value will be multiplied when the construction is finished and the luxury apartments are put up for sale. Listings for the sale of newly built apartments in the same neighborhood indicate that a single apartment can go for as much as 24 million Turkish lira. Trend’s contract envisages that it will own six apartments out of 34 in the building, meaning that Trend will have generated a huge profit once the building is completed.

Land registry records indicate that Trend is the co-owner of the property with most shares in the plot, with the remaining shares owned by private citizens. Two aging buildings currently stand on the land, and they are slated for demolition to make way for the new construction project.

Registration filings reveal that Trend acquired shares in the property throughout 2022, even acquiring some shares from the Istanbul Greater Municipality, which is run by the main opposition Republican People’s Party (CHP). However, Yetkin’s property assessment highlighted a limitation in investigating activities on the property in the three years preceding its sale to Trend and others. This restriction arose due to the denial of permission to access records held at the Eyüpsultan Land Registry Authority.

Assessment prepared for the property owned by Trend in Istanbul:

The certification from the pro-Hamas government led by President Recep Tayyip Erdogan on November 3, 2022 stating that the two buildings on the property posed a risk to their surroundings and qualified for demolition, suggests that the government has cleared potential obstacles for Trend to proceed with the construction of the apartment complex on the property.

This property development is not the sole revenue-generating project for Trend in Turkey. The company is involved in multiple development projects across Istanbul and other Turkish cities. While some projects have already been successfully completed, others are still in progress, indicating a diverse portfolio of ongoing ventures for Trend.

In the Görükle neighborhood of the Nilüfer district in Turkey’s northwestern province of Bursa, Trend is nearing completion of its property development project known as Trend Boulevard. This project consists of 240 apartments and six commercial spaces. The average sales price for each apartment is approximately 1.6 million Turkish lira. Additionally, the company is actively engaged in another property development project in Istanbul’s Ümraniye district, where it acquired a parcel for 90 million Turkish lira specifically for development purposes.

The company has also been raising capital through the public offering of its shares on the Istanbul Stock Exchange. Remarkably, the percentage of publicly traded shares has shown an increase, rising from 45.74 percent at the beginning of January to 55.40 percent by the end of September. This growth was achieved with the approval of Turkish regulatory authority the Capital Markets Board (Sermaye Piyasası Kurulu, SPK), despite the red flagging of the company under the sanctions regime imposed by the US.

As of the end of the third quarter, the company’s financial statement revealed total assets valued at 189.6 million Turkish lira, with a significant portion derived from real estate management and ownership amounting to 166.8 million lira. The company reported a net profit of 27 million lira in the same period.

The US sanctions designation of Trendyol seems to have had no discernible impact on Trend’s operations in Turkey. Despite the sanctions, Trend has not only continued its operations but has also expanded them with lucrative new deals.

Trend’s current shareholders:

On October 29, in response to the US designation, Trend stated that the company undergoes regular audits by the SPK, ensuring that every financial transaction complies Turkish law. Furthermore, the company explicitly denied providing any financial support to any organization.

As of September, the current shareholders included Arwa Saleh M. Mangoush, Osama Yahya O Felali, Gülşah Yiğidoğlu and Alaeddin Şengüler. Felai holds the largest percentage of shares at 34.33 percent, followed by Mangoush with 14.37 percent. The board of directors is composed of chairman Şengüler, Yiğidoğlu, Ensar Polat, Mustafa Khalil Mustafa Aljallad, Orhan Albayrak and Mustafa Saka.

In 2018, however, the composition of the board was quite different. Salah Mabrouk O Mangoush, Hisham Younis Yahya Qafisheh (also known by his assumed Turkish name, Haşmet Aslan) and Hamid Abdullah Hussein Al Ahmar were all board members. However, they were subsequently removed, most likely to present the company as being problem-free by eliminating the names of sanctioned individuals. It’s worth noting that the current board members have also faced new US designations, indicating ongoing challenges and scrutiny for the company.

The alteration of names, removals and replacements among shareholders or board members seems to be merely cosmetic changes for the company. Despite these adjustments, the company’s operations appear to remain unchanged.

Trend is not the only company affiliated with Hamas operating in Turkey. Şengüler, the chairman of Trend’s board, also holds the position of chairman of the board in the Nasip Gayrimenkul Ticaret A.Ş. real estate firm Additionally, Polat, an attorney, is associated with a law firm called DYS Avukatlık, while Saka owns technology company LFB Teknoloji ve Danışmanlık A.Ş. Furthermore, Yiğidoğlu established a trading company, Mevc Grup İç ve Dış Tic. Ltd. Şti., and served as its manager until this year.

The current and former shareholders of Trend also hold shares and/or board memberships in several Turkish companies.

It is obvious that the company has the support of Turkey’s ruling Justice and Development Party (AKP) and its chairman, President Erdogan. For instance, Trend CEO Şengüler is the son-in-law of Ismail Kahraman, a former parliament speaker and one of Erdogan’s mentors. Board member Albayrak has previously held senior positions in the Istanbul branch of the AKP and has shares in various companies, including computer and education firm Alkom Bilgisayar Eğitim ve Fidancılık Ltd. Şti, energy company Engy Biyoteknoloji Çevre ve Enerji Ltd. Şti, and technology development company Marmara Üniversitesi Teknopark A.Ş.