Levent Kenez/Stockholm

OYAK, Turkey’s military pension and investment fund, has signed a far-reaching agreement with Somalia that centralizes the licensing and regulation of fishing across the country’s maritime zones under a newly established company controlled by OYAK, putting a strategic natural resource in the hands of a defense-linked institution with no prior track record in fisheries management.

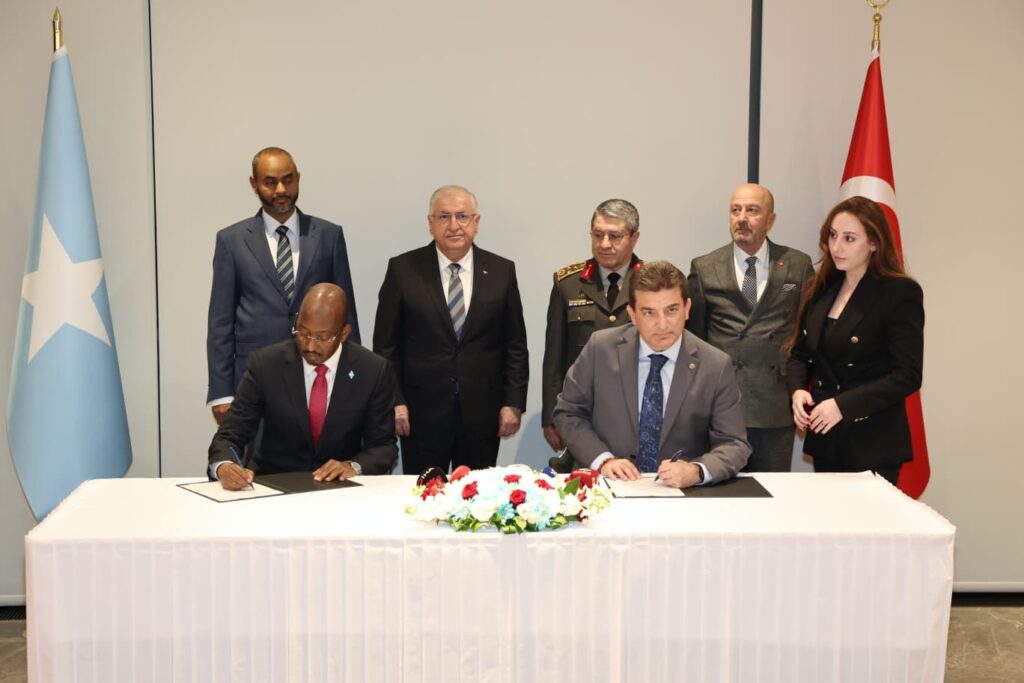

The agreement, titled “Strategic Cooperation and Service Agreement,” was signed by OYAK and Somalia’s Ministry of Fisheries and Blue Economy on December 17 at a ceremony attended by Turkish Defense Minister Yaşar Güler, Somalia’s minister of ports and maritime transport, Abdülkadir Muhammed Nur, and Turkey’s chief of general staff, Gen. Selçuk Bayraktaroğlu. OYAK board Chairman Zekai Aksakallı was also present.

Under the terms announced by the parties, a joint company named SOMTURK was incorporated in Somalia on December 11. SOMTURK has been granted exclusive authority to issue fishing permits, register vessels, monitor activity and enforce regulations across Somalia’s territorial waters and its exclusive economic zone (EEZ). All fishing in Somali waters will require authorization from SOMTURK, and all activity will be recorded and monitored through systems overseen by the company.

The arrangement effectively transfers the administration of Somalia’s fisheries, a sector with significant economic potential, to an entity controlled by Turkey’s military pension fund. OYAK has extensive holdings in sectors such as steel, cement, automotive manufacturing, chemicals, logistics and energy, but it does not have a publicly documented history of managing national fisheries or marine resource governance.

The timing of the deal is noteworthy. SOMTURK was established only six days before the agreement was signed, yet it was immediately granted exclusive authority over fisheries licensing and regulation. The rapid empowerment of a newly formed company has reinforced concerns that OYAK is benefiting from government-backed favoritism rather than operating under normal free-market conditions.

Somalia has one of the longest coastlines in Africa, stretching more than 3,300 kilometers along the Indian Ocean and the Gulf of Aden. Its EEZ covers roughly 825,000 square kilometers and is considered among the richest fishing grounds in the region. According to estimates by the United Nations’ Food and Agriculture Organization and regional marine studies, Somali waters host abundant stocks of tuna, sardines, mackerel, lobster and ground fish with a potential annual catch worth hundreds of millions of dollars.

Decades of state collapse, however, have left Somalia unable to police its waters effectively. Illegal, unreported and unregulated fishing by foreign fleets has been widespread since the early 1990s, depriving the country of revenue and contributing to the economic grievances that once fueled piracy. Successive Somali governments have struggled to build regulatory capacity, surveillance systems and a coherent licensing regime.

The OYAK agreement is presented by Ankara and Mogadishu as a response to that governance vacuum. It aims to establish a single licensing authority, protect marine resources and create a revenue stream while offering Turkish fishing companies access to Somali waters.

Yet the transfer of licensing power to a foreign, military-linked entity has raised questions about sovereignty and oversight, particularly in a country still dependent on external security assistance and donor financing.

OYAK, established in 1961, is one of Turkey’s largest economic institutions. As of 2023 it managed assets estimated at more than $30 billion and operated more than 130 subsidiaries in about 20 countries. Its mandate is to provide pensions and financial security to Turkish Armed Forces personnel, funded largely through mandatory monthly deductions from salaries.

The fund’s leadership has become increasingly politicized in recent years, according to court filings and reporting in the Turkish media. Its current chairman, retired Lt. Gen. Zekai Aksakallı, was appointed in July, replacing a board selected only weeks earlier.

Aksakallı is a controversial figure in Turkey’s recent history. As commander of the Special Forces during a July 15, 2016, coup attempt, he ordered the killing of Brig. Gen. Semih Terzi, who was alleged to be part of the plot. Subsequent court proceedings and investigative reporting raised questions about the circumstances of Terzi’s death, including testimony that evidence was manipulated after the incident and allegations that Terzi may have been lured to Ankara.

Human rights groups and defendants in coup trials have also cited video footage showing Aksakallı physically abusing handcuffed officers after the coup attempt.

According to a report by Nordic Monitor, Col. Fırat Alakuş, a former officer in the intelligence division of the Special Forces, testified in March 2019 at the Ankara 17th High Criminal Court that Terzi had discovered Aksakallı was secretly working with Turkey’s National Intelligence Organization (MİT) to conduct illegal operations in Syria for personal gain. Alakuş said Terzi knew how much of the Qatari funding intended for arming Syrian opposition groups was actually used for that purpose, how much was embezzled and which public officials were involved. He claimed that this knowledge was the real reason behind Aksakallı’s execution order.

Alakuş also claimed that Terzi was aware of Turkey’s involvement in oil smuggling from Syria and how government officials were aiding extremist militant commanders. According to Alakuş, Terzi opposed Turkish intelligence supplying weapons and training to radical groups portrayed as moderate rebels. He concluded that Terzi’s death resulted from a trap set by Aksakallı to keep such information from becoming public.

Aksakallı was forced into retirement in 2020 and later returned to prominence through his appointment to OYAK, a move widely interpreted in Turkey as political rehabilitation with presidential approval.

The fisheries agreement comes as Turkish intelligence analysts themselves warn of Somalia’s structural fragility. A recent report by Turkey’s National Intelligence Academy examining Turkey-Somalia relations describes a country facing sustained militant threats from al-Shabab, unresolved federal power disputes, weak state institutions, climate-driven shocks and external geopolitical pressures along the Red Sea corridor.

The assessment concludes that Somalia remains unable to secure its territory or economy without external backing and that gaps in governance create vulnerabilities in large-scale projects. It cautions that disputes between the federal government and regional administrations over revenue control and authority directly affect foreign-backed initiatives that rely on centralized decision-making.

By centralizing fisheries licensing under SOMTURK, the OYAK agreement intersects directly with those risks. Revenue from fishing licenses has long been a contentious issue between Mogadishu and federal member states, particularly Puntland and Jubaland, where much fishing activity occurs.

Turkey has steadily expanded its footprint in Somalia since President Recep Tayyip Erdoğan’s landmark visit to Mogadishu in 2011. Turkish involvement spans humanitarian aid, infrastructure, health care, port and airport operations and military training. Camp TURKSOM in Mogadishu is Turkey’s largest overseas military base and has trained more than 15,000 Somali soldiers.

Parliamentary debates in Turkey and reporting by investigative outlets have described Somalia as a test case for Ankara’s foreign policy model — security engagement followed by economic access for pro-government companies. Turkey operates the Port of Mogadishu and the Aden Adde International Airport through Turkish firms and has signed recent agreements covering hydrocarbons and defense cooperation.

Critics in Turkey have argued that this approach treats Somalia as a source of profits for politically connected business interests

OYAK itself is facing legal disputes at home. Members of the fund have filed lawsuits alleging mismanagement, undervalued asset sales and unexplained discrepancies between declared donations and figures cited in independent audit reports. In one case the sale of OYAK Cement shares in 2023 was challenged on the grounds that it caused losses amounting to billions of lira. Other filings cite gaps of more than 175 million lira between board decisions and audit figures in reported donations across two subsidiaries.