Levent Kenez/Stockholm

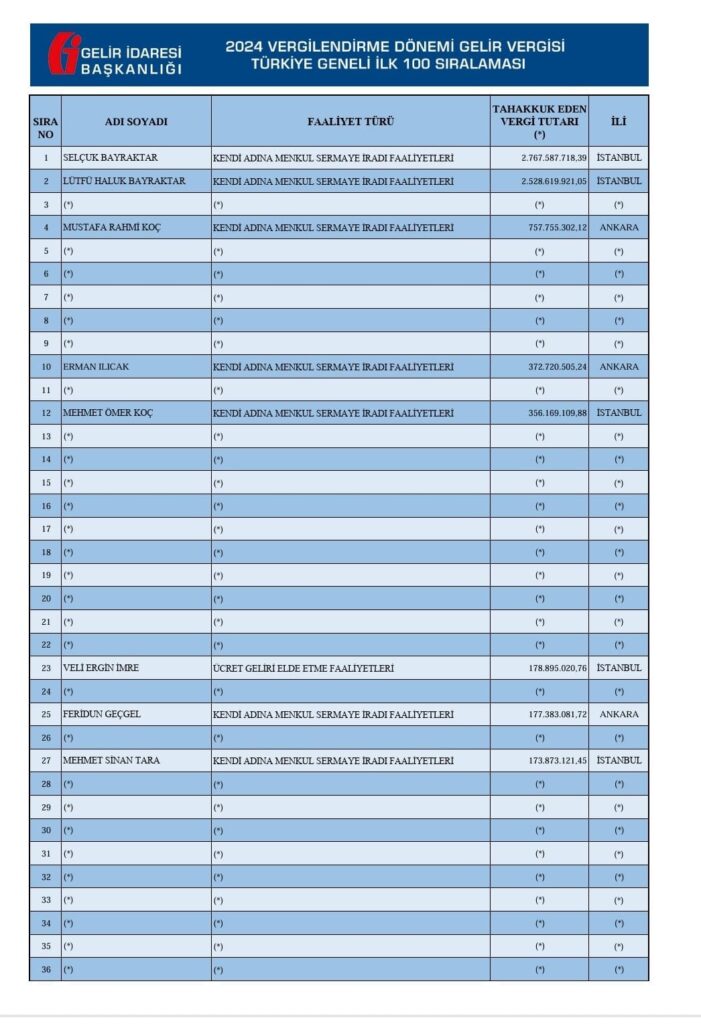

Turkey’s 2024 income tax records, released on August 20, 2025, reveal a growing trend of wealthy individuals and corporations choosing to hide their identities, raising questions about transparency and the sources of private wealth. While the government publishes the top 100 taxpayers each year, the majority now prefer anonymity.

In 2013, 35 leading taxpayers withheld their names. By 2018, that number had grown to 62, rising to 67 in 2020, 74 in 2021, 76 in 2022 and 79 in 2024. This means nearly four out of five of Turkey’s wealthiest contributors opted not to reveal themselves.

The trend coincides with growing concerns about organized crime and mafia-style networks in Turkey. Reports of smuggling, protection rackets and cross-border trafficking have become more frequent, while secrecy among top taxpayers has expanded. Observers note that opacity shields wealthy individuals from scrutiny by the public, competitors, employees and political rivals.

Some business owners also want to prevent employees, unions or others from knowing their earnings in an inflationary environment, which could complicate wage negotiations. Others fear extortion demands from criminal organizations or sudden financial or business crises triggered by social or political connections

Political ties also influence tax disclosure. Businesspeople close to President Recep Tayyip Erdogan have appeared on past lists, but many now refuse public identification. Critics argue this reflects a climate in which politically connected entrepreneurs accumulate large profits through government contracts, construction projects or energy deals while avoiding public attention. Wealth and power are closely intertwined in Turkey, and anonymity on the tax list helps prevent debate about favoritism or corruption.

Official data for 2024 show that 5,132,895 people filed annual income tax returns nationwide. The filings reported a combined tax base of 1.4 trillion lira (around $37.3 billion) with 418.4 billion lira ($11.1 billion) in assessed income taxes. The average annual income for Turkish taxpayers was 274,288 lira ($7,300), and the average tax assessed was 81,526 lira ($2,170).

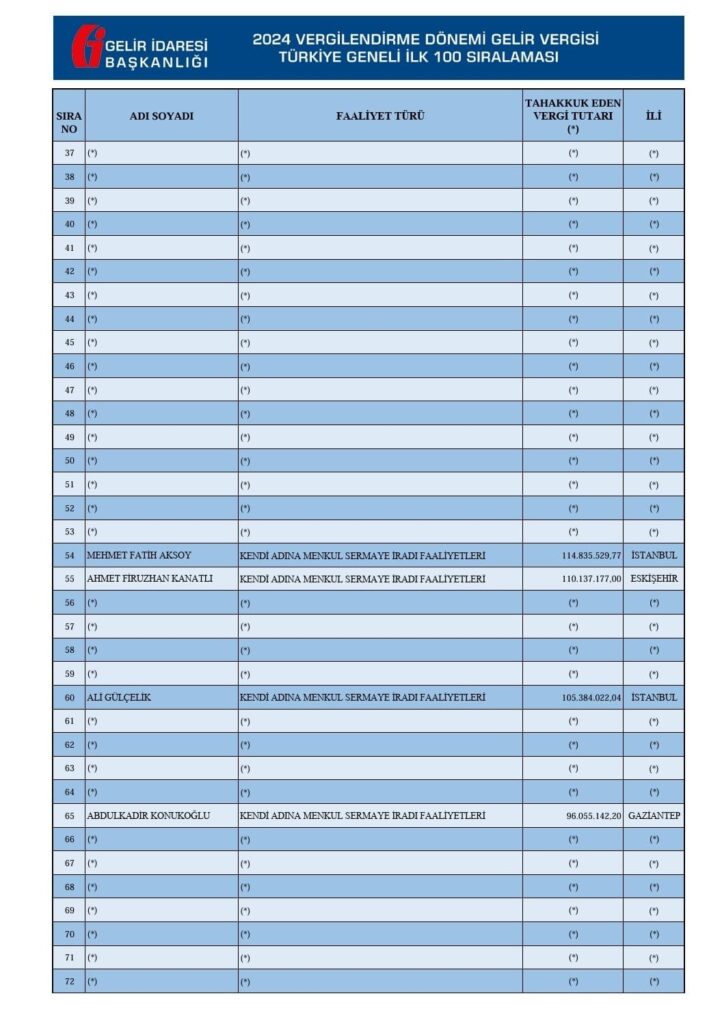

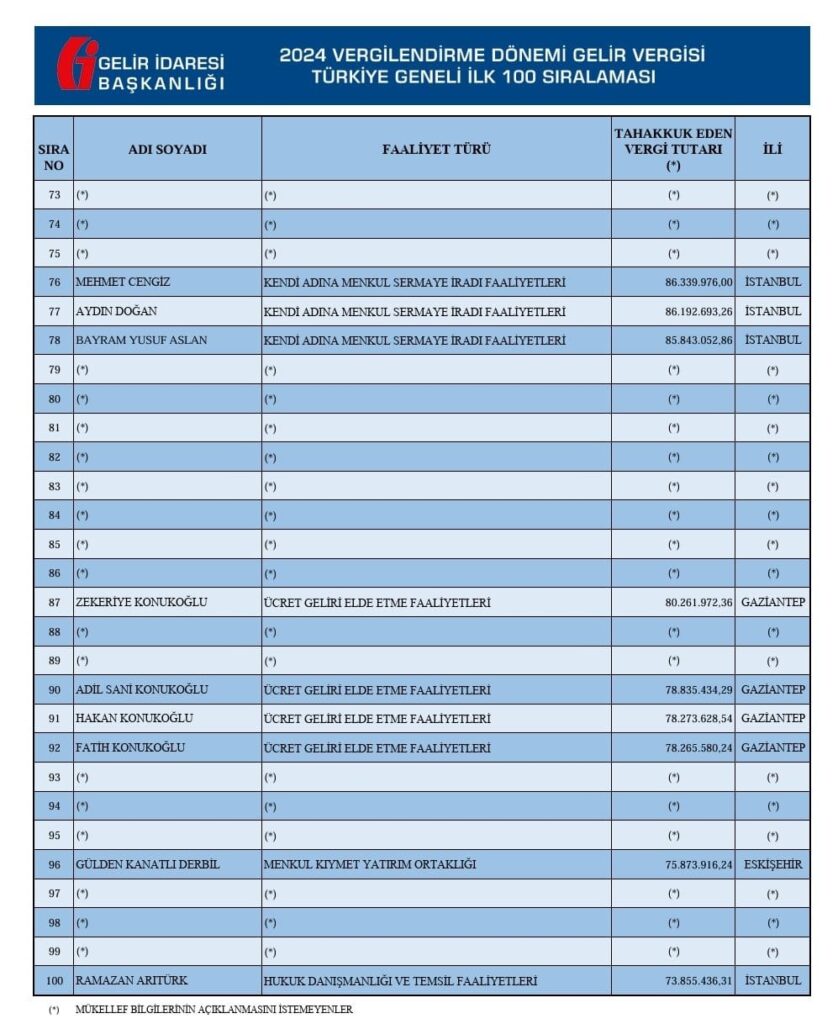

Among the top 100 taxpayers, Istanbul led with 75, followed by Ankara with 10, Izmir with six, Gaziantep with five, Eskişehir with two and Bursa and Karabük with one each. Yet 79 of these top taxpayers chose not to have their names published, leaving only 21 visible. This reluctance contrasts with practices in other countries where top taxpayers are often celebrated. In Turkey the secrecy has fueled suspicions that some anonymous taxpayers may be connected to illicit activities.

79 of the top 100 income taxpayers in 2024 chose to conceal their identities:

Companies, not just individuals, also increasingly conceal their identities. Corporate taxpayers at the top of the scale are often reluctant for their names to appear publicly, citing similar concerns over transparency, competitive disadvantage and pressure from outside groups. Historically, Turkey held ceremonies to honor top taxpayers, but these events have long been discontinued as more and more people refuse public recognition.

During the 2024 tax year, a total of 1,171,443 corporate taxpayers filed returns across Turkey. These filings declared a combined corporate tax base of 4.344 trillion lira ($115.9 billion), generating 990.5 billion lira ($26.5 billion) in assessed corporate taxes. On average, each taxpayer declared a base of 3.708 million lira ($99,000) and faced an average corporate tax assessment of 845,557 lira ($22,200).

The top 100 corporate taxpayers were concentrated in major economic hubs. Istanbul led with 78 companies, followed by Ankara with 15 and one each in Izmir, Antalya, Bursa, Kocaeli, Şanlıurfa, Balıkesir and Bolu.

Banks dominated the top of the list. Garanti Bank had the top position with an assessed corporate tax of 25.3 billion lira ($674 million), followed by Ziraat Bank with 20.8 billion lira ($555 million) and Kuveyt Türk Participation Bank at 12.1 billion lira ($323 million). Other notable institutions included Türkiye Elektrik İletim AŞ, Türkiye Vakıflar Bankası Türk AO and the State Airports Authority Directorate General.

In some cases taxpayers chose to remain anonymous. The seventh and ninth-ranked companies did not permit their names to be disclosed, and overall, 32 of the top 100 corporate taxpayers opted for secrecy.

Nordic Monitor previously reported that Turkey’s interior minister revealed that the country had become a haven for organized crime networks, drug traffickers, cybercriminals and internationally wanted fugitives. Minister Ali Yerlikaya said more than 660 organized crime groups had been dismantled in the past year. Between June 2023 and August 2024 Turkish authorities conducted over 1,600 operations, detaining 11,635 people and arresting more than 4,500. Conviction numbers were not provided, and most detainees are released at the first hearing. Many acquittals occur due to the political connections of crime groups and the judiciary’s subordination to the executive branch.

During the same period, 552 INTERPOL fugitives were arrested, highlighting concerns over border security and international cooperation. Critics suggest financial incentives and political connections have allowed criminal groups to operate in Turkey. Lawmaker Cevdet Akay estimated that $76.7 billion in funds of unidentified origin have entered the Turkish economy during Erdogan’s two decades in power compared with $1.7 billion between 1984 and 2001.

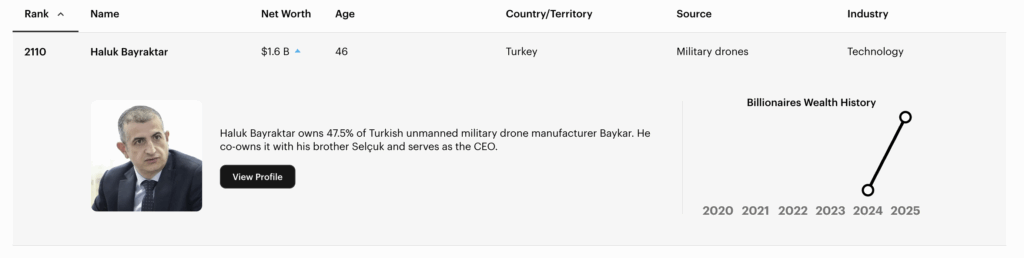

Meanwhile, the top individual taxpayer in 2024 is Selçuk Bayraktar, chairman of defense contractor Baykar, with an assessed tax of 2.7 billion lira ($71.6 million). Second was his brother Haluk Bayraktar at 2.5 billion lira ($66.3 million). The third-ranked taxpayer chose anonymity, while the fourth was Mustafa Rahmi Koç, the honorary chairman of Koç Holding, who was assessed 757 million lira ($20.1 million) in income tax.

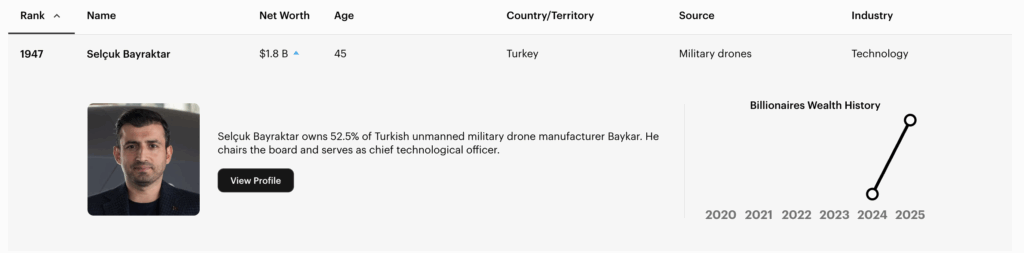

Current Forbes billionaire rankings of Selçuk and Haluk Bayraktar:

Selçuk Bayraktar is considered a top contender to lead the ruling party after Erdogan along with Erdogan’s son Bilal, though many see Bilal as more likely a successor due to family ties. Selçuk appeared on Forbes’ latest billionaire list with a net worth of $1.8 billion, while Haluk followed at $1.6 billion. Baykar drones have been exported to more than 30 countries and were used in conflicts in Nagorno-Karabakh, Libya and Ukraine. Observers attribute much of Baykar’s rapid global rise to Erdogan’s support, which has facilitated multimillion-dollar defense agreements.

Selçuk Bayraktar has been married to Erdogan’s daughter Sümeyye since 2016.