Levent Kenez/Stockholm

A new report by the Brussels-based Institute for Diplomacy and Economy (InstituDE) states that Turkey’s economic future and the modernization of its customs union with the European Union are closely tied to its adherence to the rule of law and democratic principles. The study warns that without addressing the legal and governance shortcomings, Turkey may struggle to unlock its full economic potential and secure a more balanced trade relationship with the EU.

The report, titled “Modernizing the Turkey-EU Customs Union: Issues and Prospects,” underscores that while updating the agreement could boost Turkey’s GDP by up to 2.5 percent, institutional weaknesses — particularly concerning judicial independence and transparency — pose significant risks. Turkey’s alignment with EU trade policies has led to economic benefits, but systemic issues continue to hinder further progress.

Turkey’s failure to implement rulings from the European Court of Human Rights (ECtHR), including high-profile cases such as those of imprisoned Kurdish politician Selahattin Demirtaş, businessman Osman Kavala and teacher Yüksel Yalçınkaya, is identified as a major obstacle to economic and trade relations. The study argues that compliance with these rulings is essential for rebuilding trust with European institutions and businesses. Additionally, concerns over property rights violations and opaque public procurement practices have contributed to a perception of regulatory instability. These issues deter foreign direct investment and could further delay customs union negotiations.

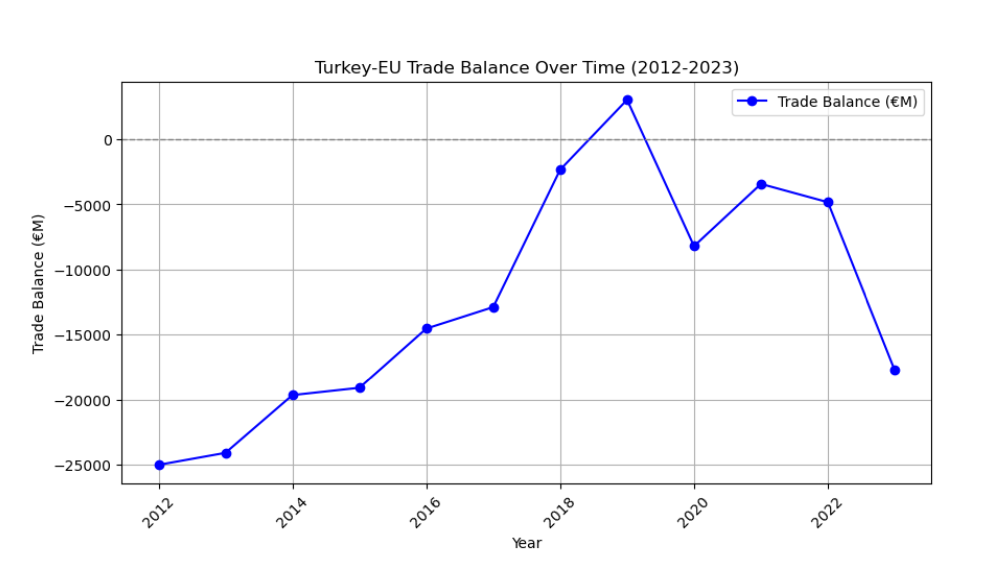

If fully modernized, the customs union could significantly enhance Turkey’s trade efficiency and competitiveness. The report outlines several economic scenarios based on different levels of modernization. In a no-modernization scenario, Turkey’s trade deficit with the EU could widen to €20 billion by 2025 due to increasing imports and declining investor confidence. A moderate modernization scenario with a 10 percent efficiency gain could improve the trade balance by 30 percent, reducing the deficit to €12.5 billion. Full modernization, which would include streamlined customs procedures, expanded digital trade and improved regulatory alignment, could cut the trade deficit by 50 percent, lowering it to €8.5 billion.

For the EU, modernization is projected to add between €20 and €25 billion in trade volume by 2030. However, the study emphasizes that economic growth alone will not be enough to drive modernization efforts forward. European policymakers are unlikely to approve reforms unless Turkey demonstrates a commitment to legal and democratic principles.

Turkey’s public procurement system is another area requiring urgent reform. The report states that Turkey’s procurement practices, which currently lack transparency and are perceived as favoring specific companies, deter European investment and create inefficiencies in trade. Although Turkey initially aligned its public procurement legislation with EU standards, successive amendments have introduced numerous exemptions that undermine fair competition. The Public Procurement Authority, originally established to oversee procurement processes, has been largely sidelined, further eroding regulatory confidence.

A modernized customs union would grant Turkey greater access to the EU’s services and public procurement markets, boosting exports and attracting investment. Sectors such as technology, finance and agriculture stand to benefit significantly from more comprehensive trade relations. The EU, in turn, would benefit from improved access to Turkey’s growing market of 86 million people, enhancing supply chain resilience and diversifying sourcing options. The EU-Turkey customs union has contributed to economic growth in both regions, but political and legal uncertainties continue to limit its full potential.

The report also highlights the growing significance of the automotive sector in Turkey-EU trade relations. Turkey’s automotive exports reached $37.21 billion in 2024, marking a 6.3 percent increase from the previous year. While Turkey remains a critical manufacturing hub for European automakers, recent EU tariffs on Chinese electric vehicles (EVs) have created an opportunity for Turkey to attract more foreign direct investment in the automotive sector. Chinese automakers, facing EU countervailing duties, are increasingly looking to Turkey as a production base to circumvent trade restrictions.

However, Turkey’s increasing role in the global EV supply chain raises key economic and policy considerations. Increased investment from Chinese EV manufacturers could boost Turkey’s automotive production capacity, create jobs and enhance technological transfer. At the same time, EU trade policymakers may scrutinize Turkey’s role in facilitating Chinese automakers’ market access, potentially leading to regulatory adjustments in the customs union framework. Ensuring that Turkey maximizes its strategic position while mitigating potential trade tensions with European partners will require careful policy planning.

Beyond trade and investment, the report warns that Turkey’s economic indicators, particularly in terms of income distribution, public debt, inflation and unemployment, have shown a downward trend in recent years. Following the 2023 presidential election, the Turkish government has attempted to stabilize the economy through policy adjustments, including efforts to restore investor confidence. However, concerns remain over the autonomy of regulatory institutions such as the central bank and financial oversight bodies. The report argues that ensuring these institutions operate independently is crucial to maintaining economic stability and attracting sustainable foreign investment.

If Turkey can signal to international markets — especially European investors — that it is committed to economic reforms, it could once again become a preferred destination for foreign capital. However, governance challenges and legal uncertainties continue to act as deterrents. Turkey’s regulatory framework, including institutions such as the Court of Accounts, is often criticized for lacking sufficient independence and transparency. For Turkey to improve its investment climate, its economic reforms must be guided by independent decision-making mechanisms and a commitment to fiscal discipline.

Agriculture is another key sector that remains outside the customs union framework, limiting Turkey’s export potential. The report indicates that Turkey’s agricultural trade surplus with the EU has remained stable, with agricultural exports to the EU reaching $8.1 billion in 2024. However, structural inefficiencies, trade restrictions and differences in subsidy policies have prevented further growth. The EU’s Common Agricultural Policy (CAP) remains a significant barrier to Turkey’s full integration into European agricultural markets.

Turkey’s agricultural policies have also been criticized for their lack of alignment with EU food safety and phytosanitary standards. Incidents of Turkish agricultural exports being blocked due to pesticide residue violations have been a recurring issue. In 2023 Turkey ranked as the top country for pesticide-related export rejections to the EU, followed by China and India. Addressing these regulatory gaps will be essential for Turkey to fully benefit from customs union modernization.

The study provides a set of policy recommendations for both Turkey and the EU. For Turkey, it calls for immediate steps to restore judicial independence, implement all ECtHR rulings, improve transparency in public procurement and strengthen anti-corruption measures. It also urges the Turkish government to address regulatory inconsistencies in agriculture and align its trade policies with EU standards. For the EU, the study suggests a phased approach to customs union modernization, prioritizing regulatory alignment and dispute settlement mechanisms to ensure fair competition.