Levent Kenez/Stockholm

The last audit report of the Turkey Wealth Fund (TWF) , which was sent to parliament three months late by the presidency, revealed that many state-owned companies couldn’t be properly audited in 2022 by independent auditors due to deficiencies in data or confidentiality issues. It was also found that some companies’ audit findings did not align with each other.

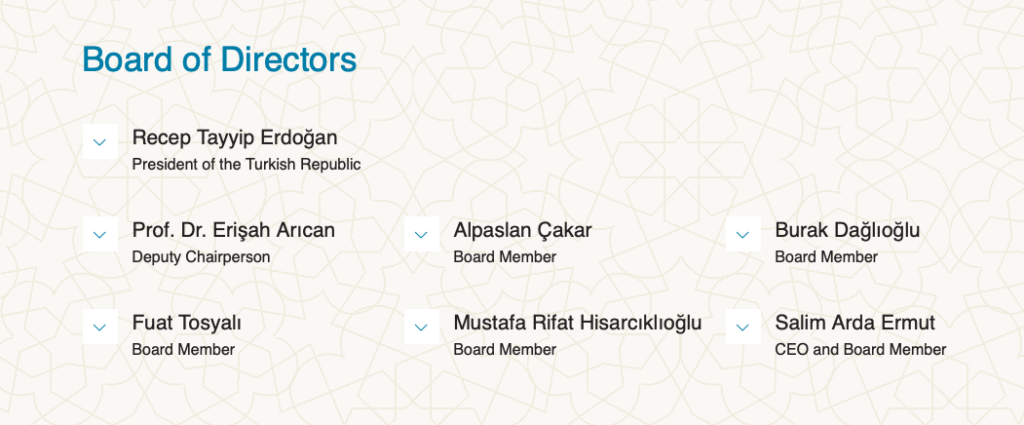

The TWF was established in 2016 to manage state-owned companies. In 2018, through a presidential decree, the fund was placed under the authority of President Recep Tayyip Erdogan, who became chairman of the fund’s board of directors. Opposition lawmakers argue that since the Presidential Inspection Board, which oversees the fund on behalf of the public, is also under the control of Erdogan, a thorough and independent audit is not possible.

The wealth fund currently encompasses 30 companies, 46 real estate properties and two gaming licenses. Among its holdings are some of Turkey’s largest companies, including Turkish Airlines, BOTAŞ, PTT (Turkish Post), Türk Telekom, Turkcell, Türksat and state-owned banks. The fund’s current estimated value is approximately $300 billion.

At a parliamentary committee meeting on February 1, main opposition lawmaker Rahmi Aşkın Türeli said the audit report arrived on January 26 and was distributed to lawmakers on January 29, leaving them with just two-and-a-half days before the meeting. He pointed out the huge number of reports, spanning thousands of pages including attachments, covering various institutions. Türeli questioned how they were expected to adequately review and discuss such extensive documentation within such a limited timeframe. He expressed skepticism about the feasibility of exercising oversight and audit authority under these circumstances.

According to the report, the independent auditing firm states that a qualified opinion has been given regarding Turkey’s natural gas company, BOTAŞ, due to the confidentiality of financial statements, making them unable to be disclosed. It was noted that sufficient and appropriate documentation could not be obtained regarding BOTAŞ’s other deferred receivables totaling TL 4.947 billion .

Furthermore, the report indicated that due to the confidential nature of BOTAŞ’s purchase price, adequate audit documentation could not be obtained. This limitation prevented alternative procedures for auditing cost details, ultimately leading to an unsatisfactory conclusion.

The government has refrained from sharing the cost of natural gas obtained from Russia with the public and parliament, citing it as confidential information.

The report highlights that BOTAŞ and the Electricity Generation Corporation (EÜAŞ) incurred a loss of $88 billion in 2022. Russia postponed an approximately $20 billion natural gas debt incurred by BOTAŞ until after 2023 since Turkey was not involved in the sanctions imposed on Russia by the West in 2022.

In the case of PTT, the report emphasized that sufficient and appropriate audit evidence regarding provisions for significant ongoing legal cases could not be obtained. It was stated that sufficient and appropriate audit evidence could not be found for the TL 41 million in receivables, TL 7.157 billion in payables and TL 1.666 billion of revenue in PTT’s financial statements.

The report also mentioned that during the independent audit conducted by both Deloitte and Any Partners for PTT in 2022, different conclusions were reached for the same accounts during the same period.

Regarding Türkşeker, a sugar refiner, which received a “qualified opinion,” it was noted that no supporting documentation could be found for the TL 2.897 billion in inventory and sales of TL 7.657 billion in the financial statements. Similarly, it was stated that an audit of sales amounting to TL 3.254 billion for Türk Tarım, an agriculture company, could not be performed, leading to a “qualified opinion.”

One of the main objections raised by opposition party members pertained to the inadequate coverage of the losses incurred by the TWF due to the purchase of Türk Telekom in 2022. The fund incurred losses due to loan repayments and currency fluctuation following its acquisition of 55 percent of Turk Telecom’s shares from LYY Telekomunikasyon (LYY) for $1.65 billion. TWF CEO Salim Arda Ermut told lawmakers during the meeting that the necessity of the state acquiring the company arose to address issues in the country’s internet infrastructure.

At the TWF, where Erdogan chairs the board, Erişah Arıcan serves as his deputy. Arıcan, an economics professor, was revealed in Wikileaks documents to have ghostwritten the doctoral thesis of Berat Albayrak, Erdogan’s son-in-law and former economy minister, implying academic misconduct.

Another board member of the TWF is businessman Fuat Tosyalı, who is closely associated with Erdogan. Growing his businesses through contracts awarded by Erdogan, Tosyalı acquired a 50.1 percent stake in armored vehicle manufacturer BMC at Erdogan’s direction for $480 million.

Rıfat Hisarcıklıoğlu, who has been president of the Union of Chambers and Commodity Exchanges since 2001, was also appointed as a board member by Erdogan in 2018. Hisarcıklıoğlu, known as one of Erdogan’s propagandists in the business world, has long been an Erdogan loyalist.

Minutes of the parliamentary committee meeting on the TWF: