Levent Kenez/ Stockholm

Turkish President Recep Tayyip Erdoğan on Tuesday announced Turkey’s strategy for foreign direct investment (FDI) for the 2021-2023 period that aims to increase Turkey’s performance in terms of both quantity and quality and issued a circular instructing all government agencies to assist the Presidential Investment Office in accordance with this strategy as foreign capital continues to flow out of Turkey.

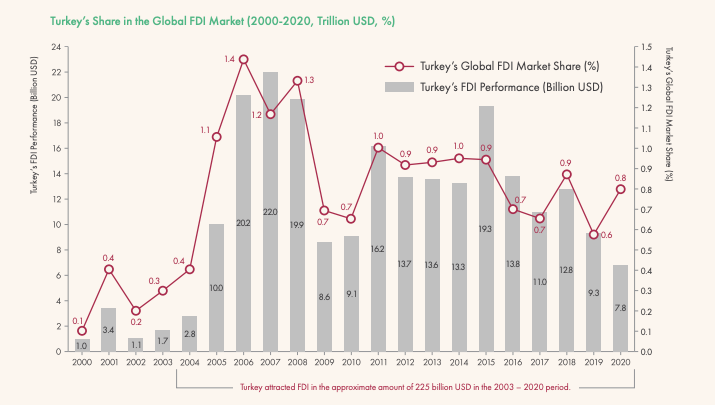

The strategy document published both in English and Turkish states that the main target of Turkey’s FDI strategy is to increase its share of the global FDI market to 1.5 percent by 2023, a figure that amounted to only 0.8 percent, at $7.8 billion, in 2020. According to the document, Turkey has designed 11 strategies and 72 actions to attract investors. Looking like a reproduction of previous strategies, the document contains many irrelevant topics and fails to offer a concrete roadmap to investors. The work, which resembles a PowerPoint presentation with general statements that everyone will agree on, seems to have been hastily prepared and not edited given the many Turkish expressions and titles in the English version. Ironically, when you click on the Presidential Investment Office’s link announcing that the document has been published, you see the message that the page is under maintenance.

Erdoğan frequently says Turkey has commercial and geographical advantages, a fair investment climate and double taxation agreements with many countries; however, foreign investors increasingly see Turkey as a politically and economically risky country particularly after Turkey introduced an executive presidential system in 2018 giving Erdoğan sweeping powers and preventing parliament from conducting its oversight of the government.

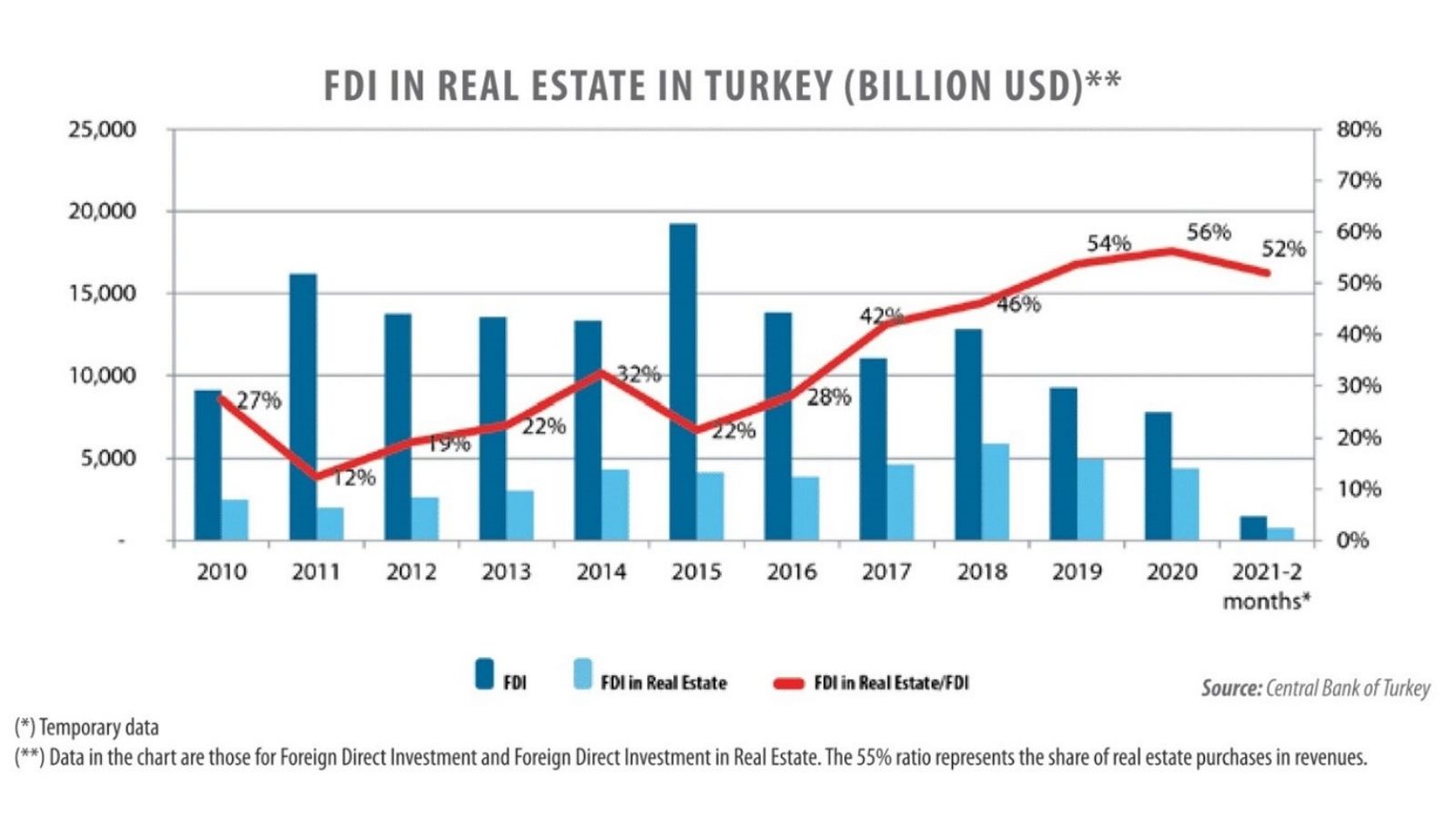

FDI, which was $12.8 billion in 2018, dropped to $9.3 billion in 2019 and to $7.8 billion in 2020. Considering that half the foreign investment was in real estate, productive capital does not seem to prefer Turkey. Hence, the FDI does not help reduce unemployment in Turkey, and the targeted number of production facilities are not opened.

According to economists, the reasons foreign investors prefer Turkey less are rapidly increasing corruption and bribery, the inadequacy of economic management, the lack of autonomy of the central bank and the volatility of exchange rates. Isolation in foreign policy and problems with Western allies also make Turkey less attractive.

In January German automotive giant Volkswagen announced that it had canceled plans for a new plant in Turkey despite the fact that it had established a local company in Turkey’s Manisa province in October 2019 with capital of around $164.5 million. Instead of the projected factory in Manisa, the company decided to expand its current production facilities in Bratislava. At the time it was claimed that Turkey’s unilateral military operations in Syria played an important role in the decision. Turkey’s industry minister Mustafa Varank said the decision by Volkswagen to pull investments out of the country was politically motivated.

No doubt, Erdogan’s government is becoming increasingly authoritarian and moving away from liberal policies, which is another reason foreign investors stay away from Turkey. The Turkish government transferred some TL 49.4 billion ($11 billion) in assets of 1,124 companies seized for alleged affiliation with the Gülen movement to a special fund under a crackdown that began following a coup attempt on July 15, 2016, according to a survey conducted by The Arrested Lawyers Initiative based in Brussels.

Another survey suggests that Turkey had a significant decline in Transparency International’s Corruption Perceptions 2020 Index (CPI), dropping 32 places since 2012 according to data released by the corruption watchdog today. The country currently ranks 86th out of 179 countries. Back in 2012, Turkey had ranked 54th in the index together with EU member states Latvia and the Czech Republic.

Circular in which Erdoğan instructed the bureaucracy to increase foreign direct investment to Turkey: