Levent Kenez/Stockholm

The latest audit report for the Turkey Wealth Fund (TWF) shows that the state-run fund accumulated more than 10.6 trillion Turkish lira (approximately $246 billion) in total debt, while independent auditors were unable to fully examine several major subsidiaries because of confidentiality restrictions, according to official records discussed in parliament.

The audit report covering the fund’s 2024 financial statements and activities was presented to the Turkish Parliament and discussed during a session of the Planning and Budget Committee on January 14, 2026. According to the report, the Turkey Wealth Fund’s total assets reached 12.713 billion lira (approximately $294.8 billion) in 2024, up from 9.354 trillion lira (around $216.9 billion) in 2023. Over the same period, the fund’s total liabilities rose to 10.671 billion lira (about $247.5 billion), exceeding the 10 trillion lira threshold for the first time.

Of the total debt reported for 2024, 8.81 trillion lira (approximately $204.4 billion) consisted of short-term liabilities, while 1.857 trillion lira (around $43.1 billion) was classified as long-term debt. The audit report shows that the fund’s total liabilities increased by 35.3 percent compared to the previous year.

The fund and its subsidiaries recorded a consolidated net profit of 371.3 billion lira (about $8.6 billion) during the reporting period. The sharp rise in asset value and profitability coincided with a significant expansion in borrowing, according to the audited financial statements.

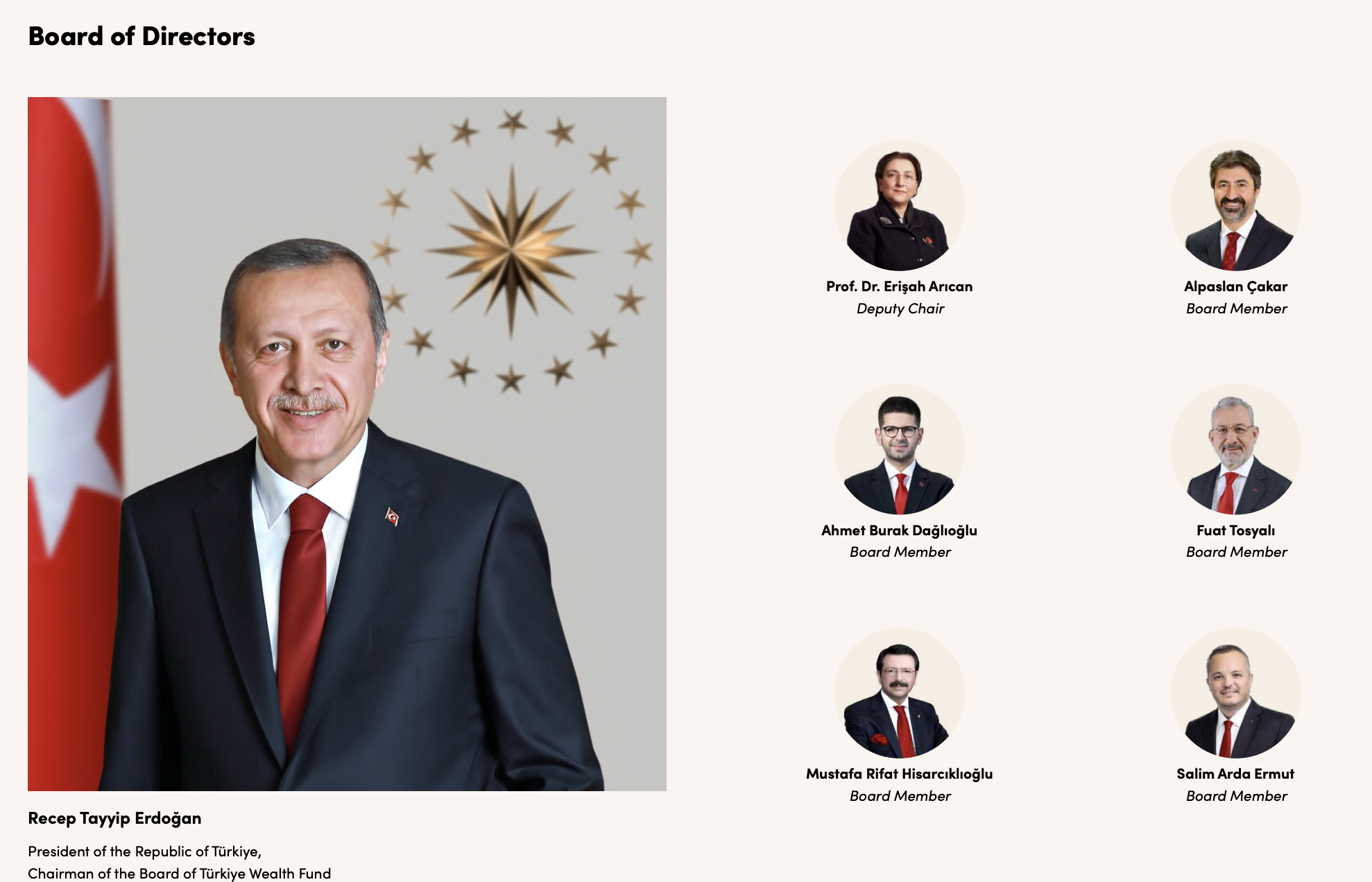

The Turkey Wealth Fund was established in 2016 to consolidate and manage some of the country’s most valuable state-owned assets. In 2018 a presidential decree placed the fund under the authority of President Recep Tayyip Erdogan, who serves as chairman of the board of directors. The fund reports directly to the presidency and submits its audit reports to parliament.

The fund’s portfolio includes major public institutions such as Halkbank, Ziraat Bank, BOTAŞ, PTT, ÇAYKUR, Turkish Sugar Factories and the İzmir Alsancak Port along with assets in telecommunications, mining, transportation and energy.

One of the most prominent findings in the audit report concerns limits placed on independent auditing because of confidentiality classifications applied to financial data. The report states that independent auditors were unable to obtain sufficient and appropriate audit evidence for several subsidiaries, leading to qualified or limited positive opinions.

In the case of the Turkish Energy Company, a subsidiary of the fund, auditors reported that they could not fully audit the company’s financial statements because of confidentiality restrictions. As a result auditors said they were unable to verify figures related to total assets, total equity and net profit.

Similar constraints were identified in the audit of BOTAŞ, the state-owned natural gas pipeline operator. According to the report BOTAŞ recorded 9.335 billion lira (approximately $216.5 million) under long-term other receivables from unrelated parties. Auditors stated that they could not obtain adequate evidence to assess this item because it was classified as confidential.

The report also noted that BOTAŞ reported inventories valued at 60.79 billion lira (around $1.41 billion) and cost of sales totaling 624.47 billion lira (approximately $14.49 billion). Auditors said they were unable to verify inventory unit costs because purchase price data were restricted under confidentiality provisions.

Limitations were also documented in the audit of Turkish Petroleum Corporation (TPAO). The company reported tangible fixed assets totaling 490.94 billion lira (about $11.39 billion) and deferred tax assets amounting to 11.45 trillion lira (approximately $256.2 billion). Auditors stated that confidentiality rules prevented them from obtaining sufficient evidence related to impairment assessments of oil and gas assets and the recoverability of deferred tax assets.

Minutes of the parliamentary committee meeting discussing the Turkey Wealth Fund audit report.

In the Turkish Sugar Factories, auditors reported that they could not obtain adequate documentation for inventories valued at 37.42 billion lira (around $867.8 million) or for cost of sales totaling 22.35 billion lira (approximately $511 million). The company received a limited positive audit opinion as a result.

The audit report shows that many subsidiaries of the fund received either qualified opinions or limited positive opinions because auditors could not fully verify certain balance sheet items or transactions. The Turkey Wealth Fund controls 33 companies operating across finance, telecommunications and technology, transportation and aviation, energy and mining, and agriculture and food. Its portfolio also includes 46 real estate assets and two gaming licenses.

Parliamentary records also show that the Turkey Wealth Fund and companies under its control have been used to channel advertising and sponsorship spending to media outlets supportive of the government, primarily through state-owned banks, energy companies and other fund subsidiaries. During the session officials confirmed that advertising, sponsorship and promotional expenditures are carried out at the subsidiary level as part of corporate budgets rather than through the fund’s central accounts, a structure that places such spending outside direct parliamentary line-item scrutiny.

During the Planning and Budget Committee session, officials from the Presidential Inspection Board stated that their review focused on whether independent audits were conducted in line with applicable standards and whether audit procedures were properly applied, based on documentation provided by the fund. The report also recalled that similar issues were identified in earlier years. The audit covering the 2022 financial year, which was transmitted to parliament three months late, found that several subsidiaries could not be properly audited because of data deficiencies or confidentiality restrictions. That report also noted inconsistencies between audit findings for different companies.

The 2024 audit confirmed that these limitations persisted. Auditors repeatedly cited confidentiality as a barrier to accessing detailed financial information, particularly in energy, finance and commodity-related subsidiaries.

The governance structure of the fund was also outlined during the parliamentary session. President Erdogan serves as chairman of the board, with Erişah Arıcan as deputy chair. Arıcan, an economics professor, was revealed in Wikileaks documents to have ghostwritten the doctoral thesis of Berat Albayrak, Erdogan’s son-in-law and former economy minister, implying academic misconduct.

Another board member of the TWF is businessman Fuat Tosyalı, who is closely associated with Erdogan. Growing his businesses through contracts awarded by Erdogan, Tosyalı acquired a 50.1 percent stake in armored vehicle manufacturer BMC for $480 million at Erdogan’s direction.

Rıfat Hisarcıklıoğlu, who has been president of the Union of Chambers and Commodity Exchanges since 2001, was also appointed as a board member by Erdogan in 2018. Hisarcıklıoğlu, known as one of Erdogan’s propagandists in the business world, has long been an Erdogan loyalist.