Levent Kenez/Stockholm

In 2025, the Turkish government plans to allocate 913 billion Turkish lira (TL; approximately $26.4 billion) for defense expenditures and TL 252 billion (approximately $7.3 billion) to the Defense Industry Support Fund, resulting in a total budget of TL 1.166 trillion (approximately $33.7 billion).

According to the government’s medium-term economic plan, Turkey’s projected gross domestic product (GDP) for 2025 is expected to reach $1.465 trillion. Based on this estimate, the defense and security budget will account for 1.8 percent of the GDP, which does not meet NATO’s recommended threshold of 2 percent. This shortfall suggests that the Turkish Armed Forces and the Ministry of Defense have not achieved the spending level advised by NATO criteria.

The exact dollar equivalent of Turkey’s defense budget for 2025 will depend on the performance of the Turkish lira against the US dollar throughout the year. According to the government’s projections, the exchange rate, currently at TL 34.7 to the dollar, is expected to reach TL 42 by the end of 2025. If this forecast materializes, the budget’s value in dollar terms will likely fall short of the planned $33.7 billion, further emphasizing the challenges posed by economic pressures and currency depreciation.

In the 2024 budget, $15.7 billion was allocated for defense expenditures and another $5.8 billion for the Defense Industry Support Fund, bringing the total to $21.5 billion. This amount increased during the year through additional appropriations.

The Turkish government asserts that the reduced share of defense spending in the GDP, currently at 1.8 percent for 2025, is justified by efficiency gains achieved through domestic production and technological advancements. It claims that NATO’s standard of 2 percent fails to account for the positive impacts of localized manufacturing, which allegedly reduces import dependency, strengthens strategic independence and significantly lowers defense costs. Additionally, it is argued that the growth of defense exports — from $250 million in 2002 to $5.5 billion in 2023 — demonstrates the economic benefits of these developments.

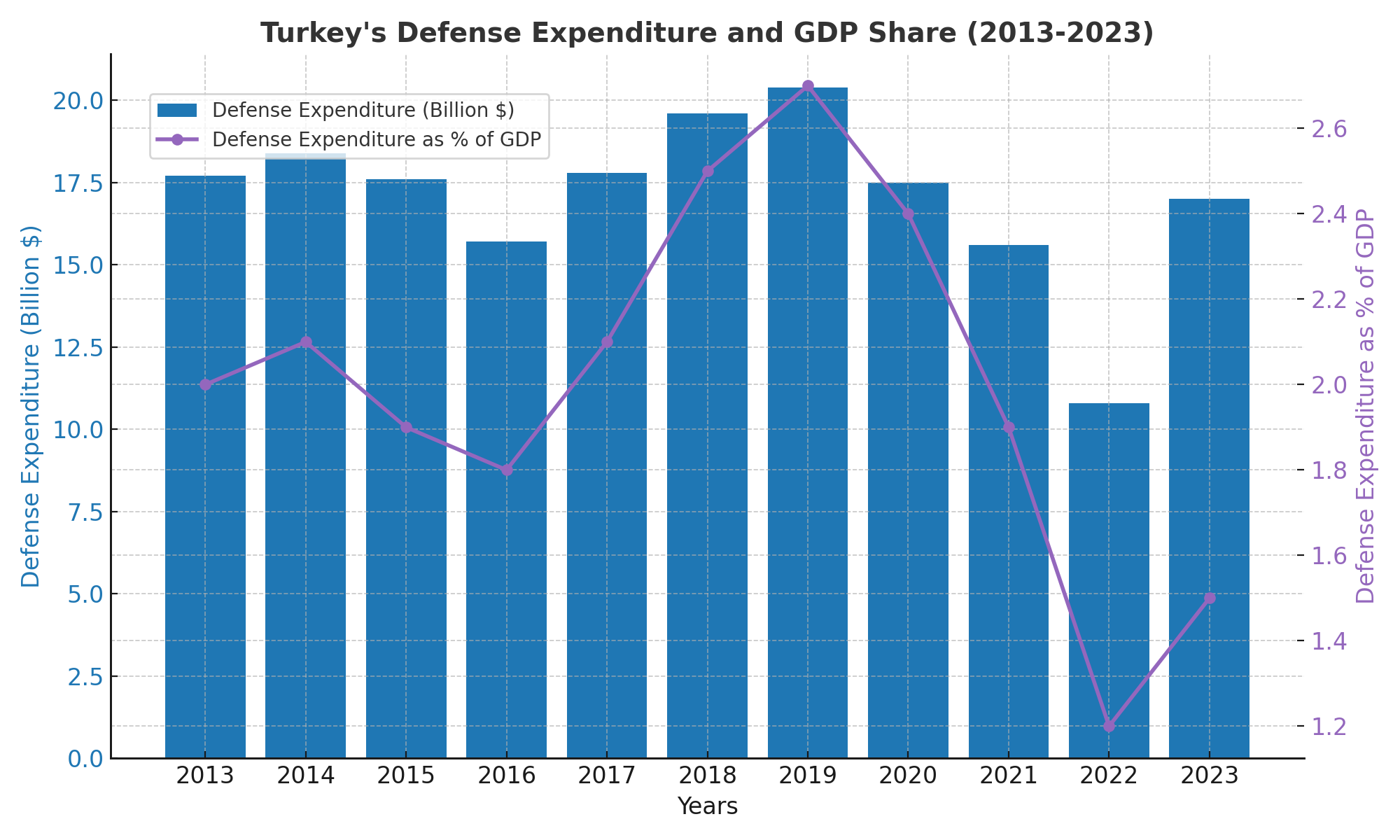

In 2001, Turkey’s military expenditures amounted to $7.2 billion, representing 3.6 percent of GDP, primarily due to the heavy reliance on costly foreign imports. By 2002, this ratio rose to 3.8 percent, but the situation began to change in the following years, according to the government, as domestic production capabilities allegedly expanded. By 2023, while defense spending reportedly increased to $17 billion, its share of GDP is said to have dropped to 1.5 percent, mainly due to the widespread use of domestically developed military technologies.

The government claims that projects such as those revolving around unmanned aerial vehicles, armored vehicles, naval platforms and missile systems, are now largely produced locally, with localization rates purportedly rising from 20 percent in 2002 to as much as 75 to 80 percent in 2023. These developments are presented as having reduced import dependency and enhancing national security and contributing to economic stability. The Turkish government maintains that these achievements provide evidence that lower defense spending relative to GDP does not necessarily undermine military capability or strategic autonomy.

The government also claims that restrictions and sanctions imposed on Turkey’s arms purchases made by NATO allies have hindered the country’s ability to fully reach the alliance’s defense spending target.

Speaking at a press conference on July 8, 2023, before departing for the NATO summit in Vilnius, Lithuania, Turkish President Recep Tayyip Erdogan expressed his displeasure over these restrictions, stating that NATO’s military embargoes are preventing Turkey from meeting the defense spending target of 2 percent set by the alliance.

“…while there are discussions about increasing defense expenditures on the one hand, we also see restrictions being imposed on the other. Unjust restrictions and obstacles imposed by some of our allies are limiting us. Our country, which reached almost 2 percent in defense spending in 2019, has currently declined to around 1.30 percent,” Erdogan told reporters. It’s not hard to guess that the countries Erdogan was referring to at the outset were Germany and the United States.

Considering that President Erdogan frequently emphasizes the need for Turkey to be militarily strong due to its location in a region rife with conflicts and has expressed efforts to implement ambitious defense industry projects, the government’s inability to allocate the desired amount to defense can largely be attributed to the country’s current economic struggles. The Turkish lira has significantly depreciated in recent years, further exacerbating the situation. This economic hardship, coupled with inflationary pressures, has made it challenging for the government to meet its defense spending goals, despite its focus on strengthening national security through domestic military advancements.

Despite the ambitious plans for advancing Turkey’s domestic military capabilities, such as the development of a Steel Dome-type air defense system and fifth-generation aircraft, the government seems to be struggling to secure sufficient funds for these projects. In an effort to close the financial gap, the government proposed a new bill to tax individuals with credit card limits over TL 100,000 ($2,923), effectively asking them to contribute to the national defense budget. The bill, which aimed to impose an annual Defense Industry Fund levy of TL 750 ($22), was met with strong public opposition and was postponed until 2025.

The ruling Justice and Development Party (AKP) is expected to revise the bill during the parliamentary committee process, including potentially raising the credit limit threshold. In response to the proposal, many credit card holders contacted their banks to lower their card limits below the TL 100,000 mark, a move seen as a clear sign of growing public mistrust in the government. This collective reaction is believed to have influenced the decision to delay the bill.

There are currently 126.5 million active credit cards in Turkey, with 17.5 million of those having limits exceeding TL 100,000. The government projected that the levy could generate about TL 13 billion ($380 million) in additional revenue.

In a live broadcast on October 16, Finance Minister Mehmet Şimşek defended the proposal, stressing Turkey’s need to strengthen its deterrence capabilities due to its geopolitical challenges. He argued that the additional funding was crucial for defense industry projects, particularly the development of a Steel Dome-type air defense system and fifth-generation aircraft.

Şimşek clarified that the tax would be strictly used for defense initiatives, stating, “This is not a package designed to reduce the budget deficit. Not a single penny will go to the general budget. The defense industry is crucial for us.”

However, his past record raised doubts about the government’s financial transparency. In 2011, while serving as finance minister, Şimşek was forced to admit that taxes collected for earthquake-resistant buildings had been redirected to infrastructure projects, including highways and new airports, which had been highly promoted by the ruling AKP. This raised concerns about whether the funds raised through new taxes would be used as intended.

Turkey ranked 22nd globally in defense expenditure in 2023, moving up one spot from the previous year with a total spending of $15.8 billion. According to the Stockholm International Peace Research Institute (SIPRI), Turkey’s military expenditures increased by 37 percent compared with 2022 and by 59 percent over the 2014-2023 period.

The report also highlighted that Turkey allocated 1.5 percent of its GDP to military spending in 2023, accounting for 0.6 percent of global military expenditures.