Abdullah Bozkurt/Stockholm

In a protracted legal battle involving Turkish state-owned Halkbank, the US Court of Appeals for the Second Circuit has ruled that the bank is not entitled to sovereign immunity and may face criminal charges for money laundering in addition to bank fraud and conspiracy to evade US sanctions against Iran.

The ruling issued on October 22 marks a significant setback for Turkish President Recep Tayyip Erdogan and his associates, who have collectively aided and abetted the use of Halkbank, officially Türkiye Halk Bankası A.Ş., to circumvent sanctions, accused of laundering approximately $20 billion in restricted funds in exchange for bribes.

The appeals court ruling followed a US Supreme Court decision clarifying that foreign sovereign immunity, as defined under the Foreign Sovereign Immunities Act (FSIA), does not protect entities like Halkbank from criminal prosecution in US courts.

However, the Supreme Court referred the case back to a lower court to examine whether Halkbank might qualify for immunity under a common law immunity provision, a secondary argument presented by Halkbank’s lawyers to avoid prosecution. The court emphasized that the appeals court should have conducted a more thorough review of this common law immunity argument.

In compliance with the Supreme Court’s directive, the US Court of Appeals conducted a thorough review of Halkbank’s second immunity claim under common law and ultimately concluded that the bank is not entitled to this immunity, thereby allowing the criminal case in the district court to proceed.

The ruling by the United States Court of Appeals for the Second Circuit regarding Turkish state lender Halkbank was issued on October 22, 2024:

Joseph F. Bianco, the presiding judge at the Second Circuit, stated that there was no basis in common law to conclude that a foreign state-owned corporation is absolutely immune from prosecution by a separate sovereign entity for alleged criminal conduct related to its commercial activities.

The case centers on allegations that Halkbank orchestrated a scheme to process transactions for Iran, thereby circumventing US sanctions intended to hinder Iran’s nuclear program and its support for cross-border terrorism activities.

Apparently acting under covert directives from Erdogan government officials, Halkbank is alleged to have used gold exports, fictitious trade and fraudulent humanitarian transactions to launder billions through the global financial system, including the US banking network, granting Iran access to restricted funds collected in a Turkish bank from Iranian oil and gas sales.

US officials had previously raised concerns about Halkbank’s illicit practices in private discussions with bank executives, who appear to have responded with deception and attempts to conceal the scheme. The covert operation to launder Iranian funds was first exposed publicly in December 2013, when Turkish prosecutors Celal Kara and Zekeriya Öz filed an indictment after a three-year investigation into an organized crime network. The indictment detailed how Halkbank managers and senior government officials accepted large bribes to facilitate sanctions evasion, assist Iranian operatives in accessing the Turkish financial system and circumvent scrutiny by Turkish regulators.

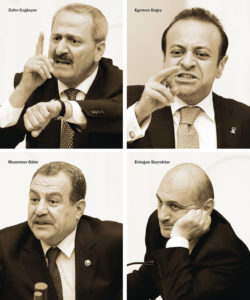

The Turkish indictment charged 53 individuals, including three now-former ministers — Interior Minister Muammer Aksoy, European Union Minister Egemen Bağış and Economy Minister Zafer Çağlayan — with bribery and abuse of power in facilitating money laundering on behalf of Iranian national Reza Zarrab.

In response to the graft investigations, which Erdogan characterized as a coup attempt, he dismissed police chiefs, prosecutors and judges involved in revealing extensive government corruption and ensured the dismissal of all charges. Following his release, Zarrab resumed his money laundering activities, again apparently with Erdogan’s support and approval.

However, US prosecutors, partly relying on evidence gathered by Turkish authorities, indicted Zarrab, then-Turkish minister Çağlayan and others in September 2017 for “conspiring to use the US financial system to facilitate hundreds of millions of dollars’ worth of transactions on behalf of the government of Iran and other Iranian entities.”

Zarrab was arrested by the FBI in Miami in 2016 while on vacation in the US and was later charged and convicted of multiple counts of violating US laws. He subsequently became a government witness, testifying against Çağlayan and members of the Turkish government, and disclosed that he had numerous ministers on his payroll.

At the conclusion of the trial in 2018, Mehmet Hakan Atilla, the deputy general manager of Halkbank, was convicted and served his sentence in a US prison before returning to Turkey in July 2019. However, the co-conspirators indicted by US federal prosecutors, including the former economy minister of Erdogan’s cabinet, remain uncharged.

The US indictment against Halkbank:

According to Zarrab’s testimony, Erdogan directed Turkish state banks to participate in a multibillion-dollar scheme in exchange for kickbacks. Documentary evidence presented during Atilla’s trial in US federal court in Manhattan referenced a figure known as “Abi” (elder brother), who is believed to be Erdogan himself, who benefited from the sanctions-evasion operation, receiving a share of the bribes. This revelation highlighted the seriousness of the allegations implicating the highest levels of power in Turkey.

President Erdogan has made repeated attempts to have the case dismissed in US courts by lobbying the administrations led by Barack Obama, Donald Trump and Joe Biden, all without success. He even orchestrated the imprisonment of US nationals and local employees of US consulates in Istanbul and Adana in an effort to pressure the US government into negotiations to drop the case in the federal court system, but these tactics have yielded no results.

In fact, the US took further action by indicting Halkbank as an institution in 2019, alleging conspiracy to defraud the US, bank fraud, money laundering and violations of the sanctions regime against Iran as established under the International Emergency Economic Powers Act.

Halkbank attempted to invoke foreign immunity in its appeal, but this was denied by Judge Richard M. Berman of the US District Court for the Southern District of New York in October 2020.

The Second Circuit upheld Judge Berman’s ruling, prompting the bank to escalate its appeal to the Supreme Court, which rejected Halkbank’s immunity argument according to the FSIA and instructed the circuit court to reconsider the immunity argument based on common law.

However, the Second Circuit upheld the lower court’s decision, concluding that common law foreign sovereign immunity does not shield the bank from prosecution for alleged criminal conduct related to its commercial activities.

The ruling underscores that the US Department of Justice’s decision to deny immunity to Halkbank is justified, as the charges stem from the bank’s commercial operations rather than any government functions. Turkish authorities have yet to determine their next steps; while they may consider another appeal, the likelihood of success appears slim. However, pursuing an appeal could potentially buy time for the Erdogan government.

This case could represent a pivotal moment in US-Turkey relations since Halkbank is closely connected to President Erdogan, who wields near-absolute power in Turkey, a NATO ally situated in a tumultuous region stretching from the Middle East to Ukraine and Russia.

The implications of this legal battle extend beyond Turkey as the outcome could significantly affect international banking practices and the enforcement of US sanctions policy.

This case has already established a precedent in the US justice system, as numerous cases involving foreign nationals, institutions and governments are now citing the Supreme Court’s decision regarding Halkbank as case law, potentially guiding how criminal and civil cases involving foreign individuals and entities are pursued in US courts.